people's pension tax relief at source

Members will get tax relief based on their residency status at the. Relief at Source.

How Pension Tax Relief Works And How To Claim It Wealthify Com

This exemption provides a reduction of up to 50 in the assessed value of the residence of qualified disabled person s Those municipalities that opt to offer the exemption.

. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000. You put 15000 into a private pension. Relief at source is a deduction.

Set up The Peoples Pension as your pension provider. You automatically get tax relief at source on the full 15000. The exact rate of relief depends on how much you earn.

Net pay v relief at source. Tax Relief for All Pennsylvanians Pennsylvania residents 2011-2012 school tax bills will be reduced by 612 million statewide thanks to slot gamblers at state casinosThe tax break is. Online Inquiry For Benefit Years.

Relief at source is also very confusingly known as net tax basis. Relief at source is the process whereby pension deductions are taken from net pay after the deduction of tax. CuraDebt is a debt relief company from Hollywood Florida.

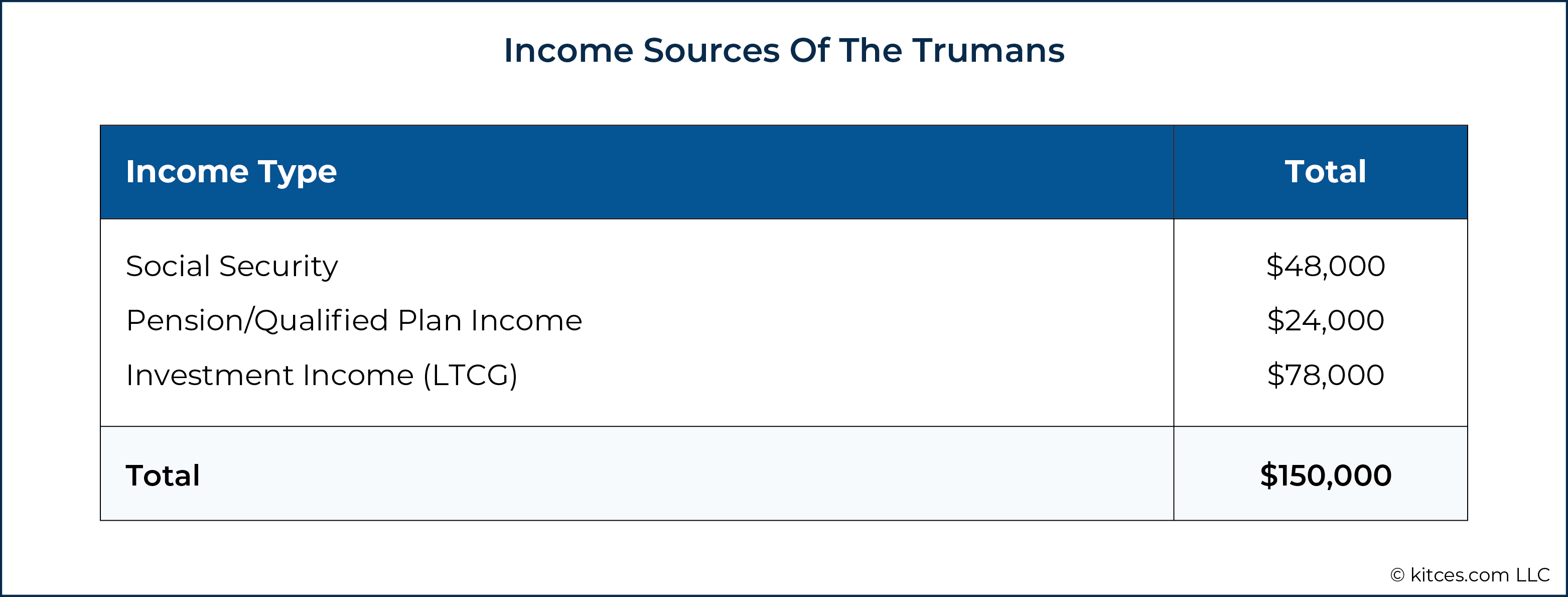

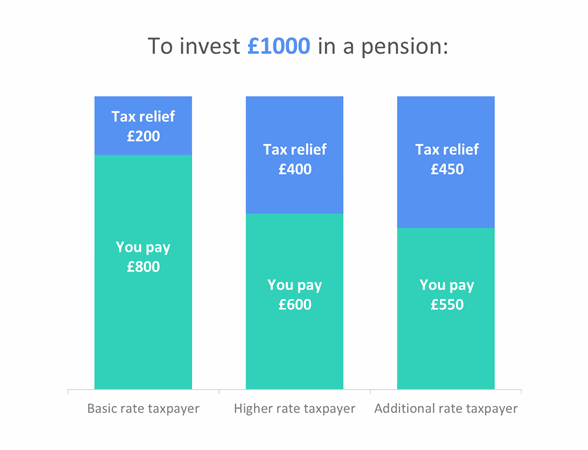

Tax relief on pension contributions may be given in two ways. There are three options to select for tax relief. Higher rate taxpayers can claim up to 40 per cent relief and additional rate taxpayers up to 45 per cent.

In a net pay scheme contributions are deducted from the employees. You can tell if its relief at source if the. Net pay v relief at source.

Jf-financialcouk net pay or relief at source. You can claim. B.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Relief at source Net pay arrangement or Salary sacrifice. 80 of the employees pension deduction will be taken via the.

You can get information on the status amount of your Homestead Benefit either online or by phone. This method is more complex as pension contributions are taken out of the salary after tax and. There are two ways that staff can get tax relief on what they pay into their pension however some providers use different names.

2018 Homestead Benefit. About the Company Pension Tax Relief At Source. The tax relief method we use is relief at source RAS which means that we claim tax relief at the basic rate of 20 back from HM Revenue Customs HMRC on behalf of an.

It was established in 2000 and has since become an active member of the. Net pay or relief at source. 14 Front Street Suite 301 Hempstead NY 11550-3602 Phone 516-560-8500 or 1-800-366-3707 Fax 516-486-7375.

Proposed Repeal Of Michigan Pension Tax Prompts Fairness Debate Bridge Michigan

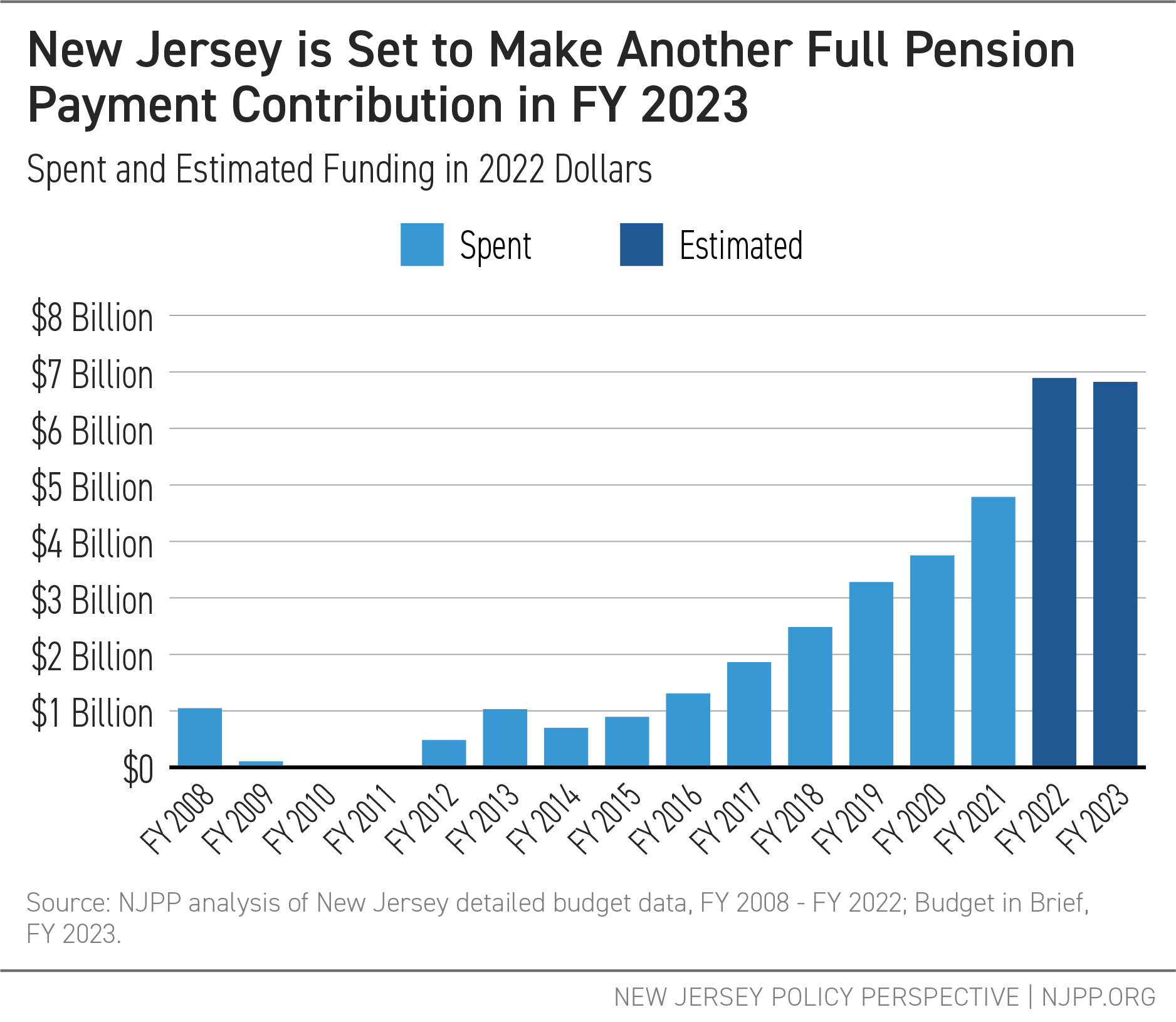

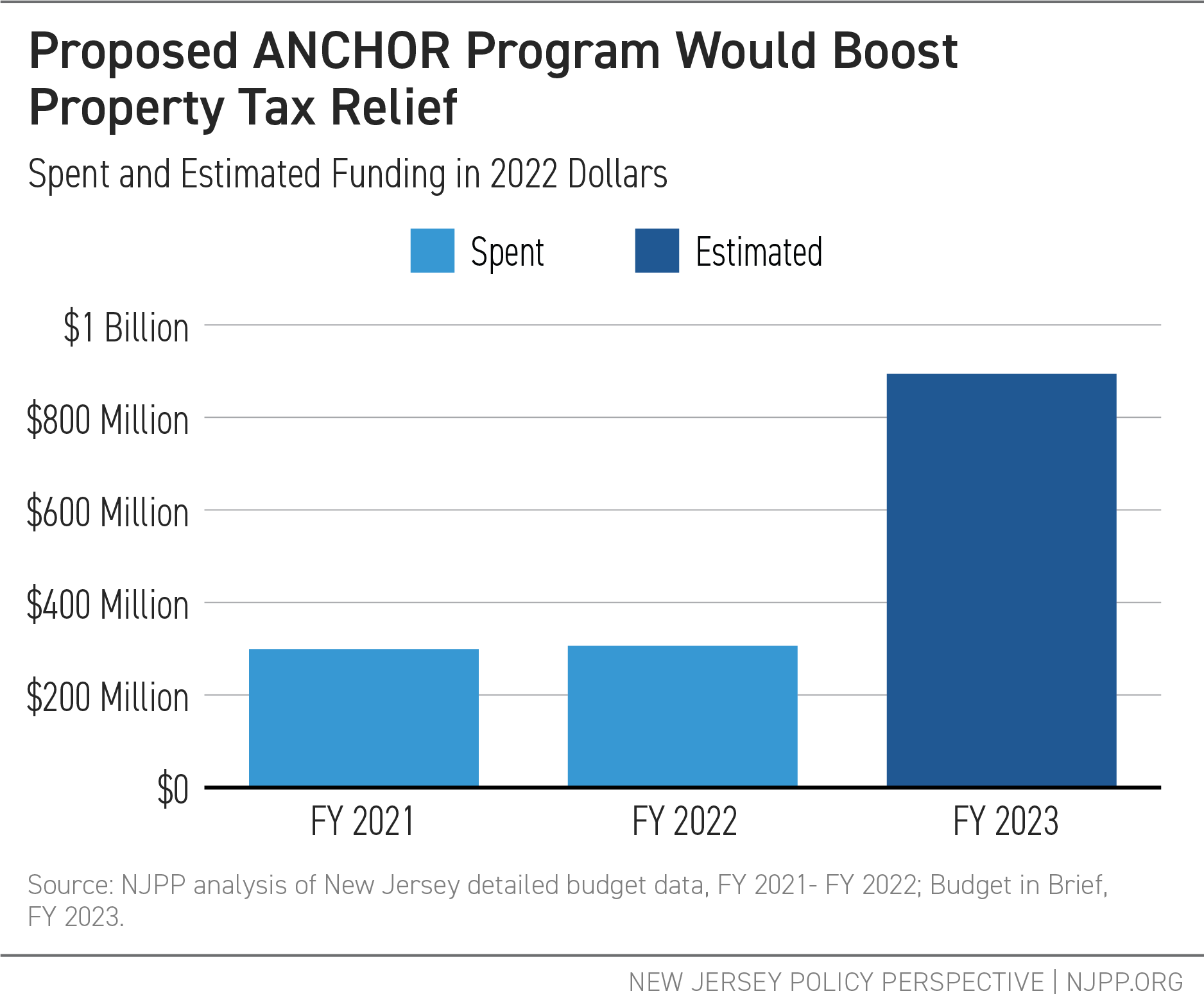

Breaking Down Governor Murphy S Fy 2023 Budget Proposal New Jersey Policy Perspective

How To Complete A Self Assessment Tax Return With Pictures

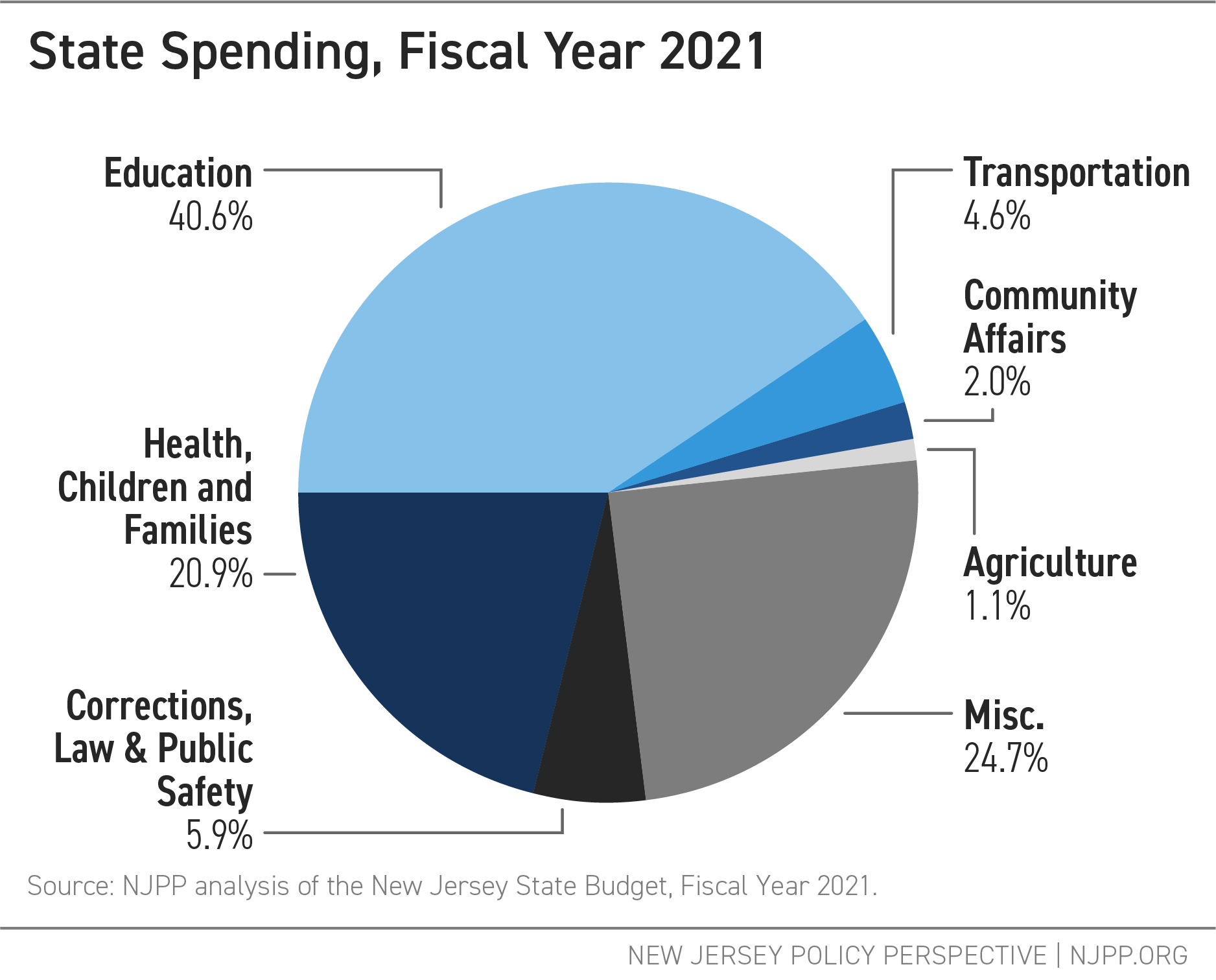

For The People By The People New Jersey State Budget 101 New Jersey Policy Perspective

Changes To Pension Tax Relief Create Few Winners And Many Losers Plsa

Temptation For Govt As Pension Tax Relief Rises To 42 7bn Ftadviser Com

Five Tax Threats To Your Pension Financial Times

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk

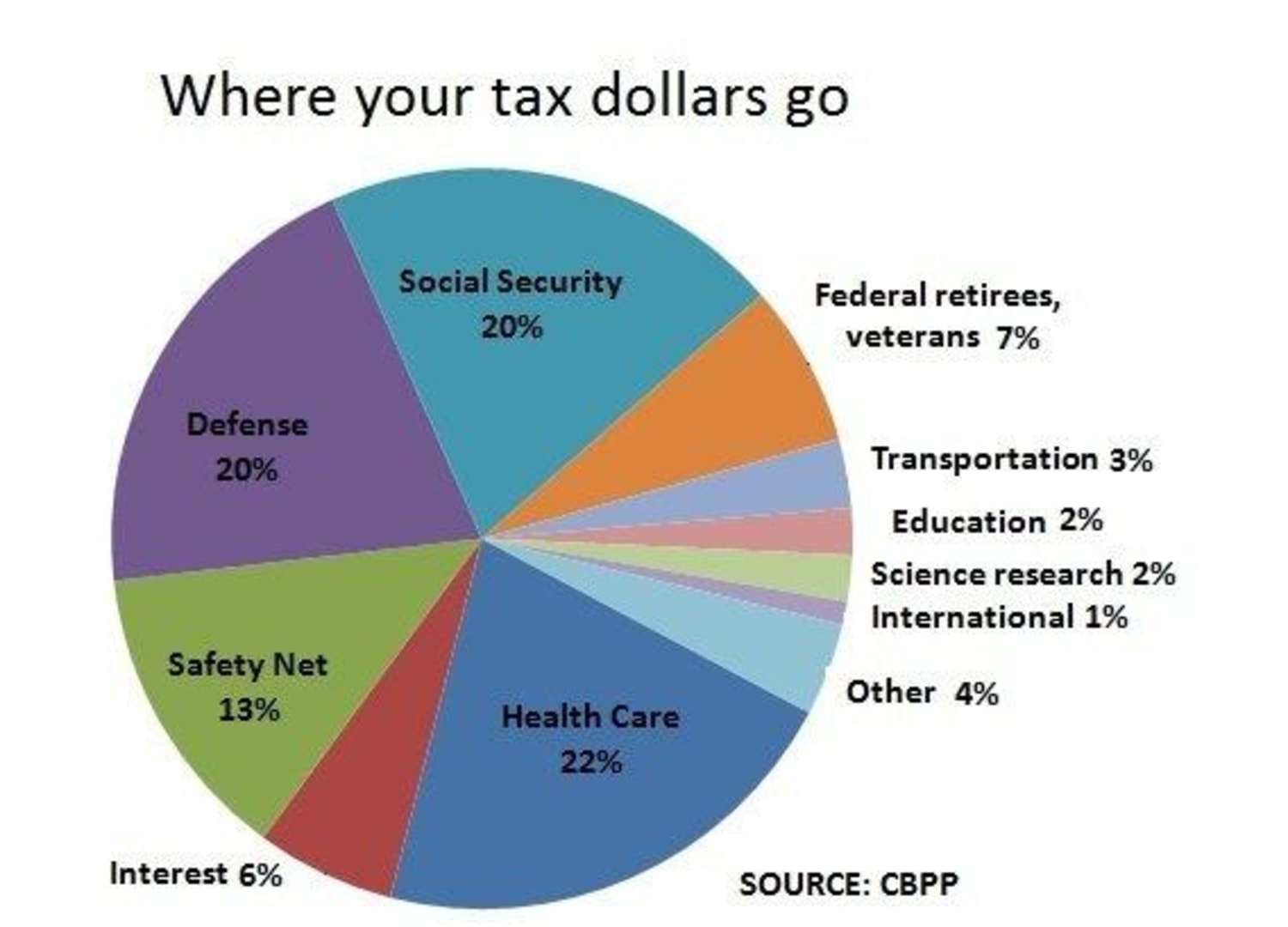

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

Tax After Coronavirus Tacs Restricting Pension Tax Relief

Breaking Down Governor Murphy S Fy 2023 Budget Proposal New Jersey Policy Perspective

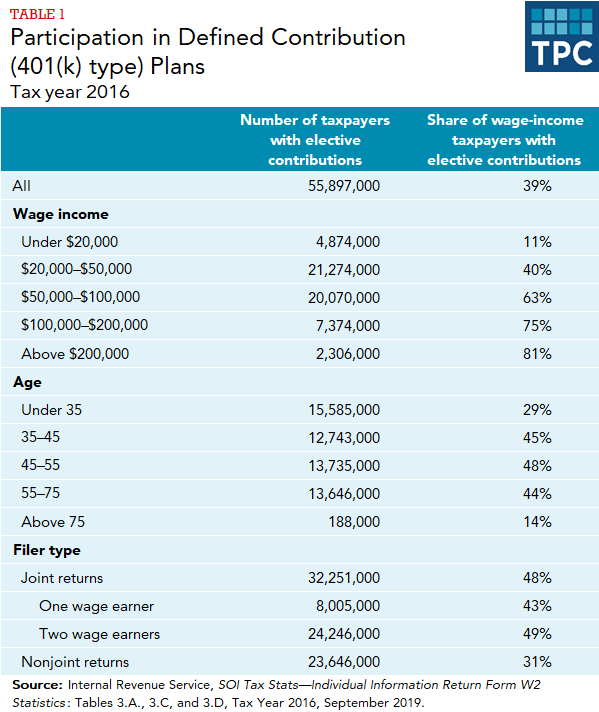

What Are Defined Contribution Retirement Plans Tax Policy Center

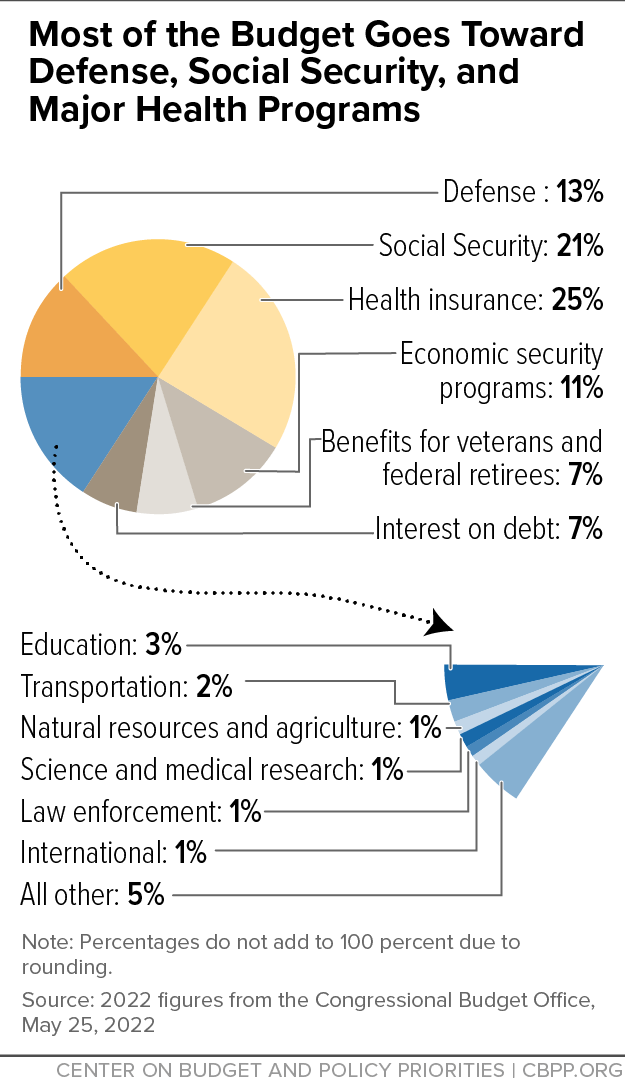

Policy Basics Where Do Our Federal Tax Dollars Go Center On Budget And Policy Priorities

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

How Do State And Local Individual Income Taxes Work Tax Policy Center