can you owe money in stocks on robinhood

Since 5000 of your initial purchase was bought on margin your portfolio value minus any cryptocurrency positions is 5000 10000 - amount borrowed 5000. Capital gains and losses are categorized by short-term and long-term.

Minimizing Capital Gains When Selling Stock In Your Robinhood Account

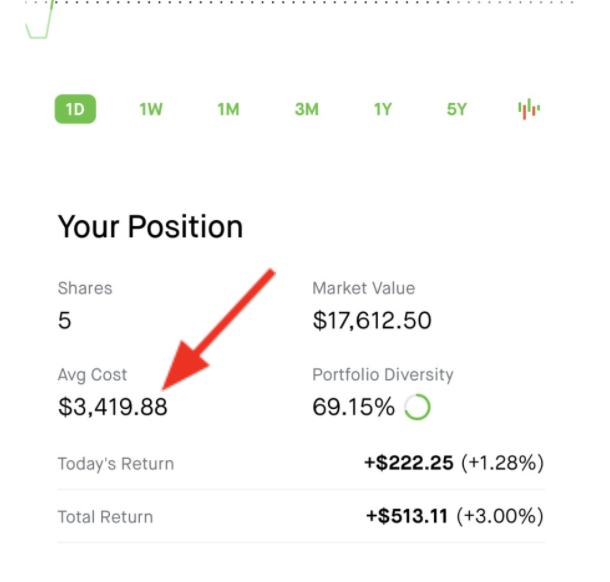

Lets say you deposit 5000 in cash and borrow 5000 on margin to buy 100 shares of a stock for 100 per sharefor a total of 10000.

. Buying on margin is one of the fastest ways to run a negative balance on your trading account and is often where new traders run into problems. If you borrowed against the portfolio to buy the options then yes you may owe on them. Go to the Robinhood website and sign up for an account.

So if you wanted to buy a stock for 100 you could put 50 of your own money in and borrow 50 from your broker. If you used cash to purchase the option in full or covered then you will not owe the option simply expires. Stocks held less than one year are subject to the short term capital gains tax rate which is the same tax rate you pay on your ordinary income.

Trade CFDs with Advanced Analysis Tools. You used your cash to buy one share and you borrowed 25 from Robin Hood to buy the second share. Furthermore Robinhood is a securities brokerage and as such securities brokerages are regulated by the Securities and Exchange Commission SEC.

How do you cash out stocks. Commodities Indices Stocks Forex Options More. You wont owe money.

Robinhood accepted his money immediately froze his account and refused to explain why. With a cash account you can only trade with money that you have invested in that. Ad 77 of retail lose money.

If you have a Robinhood Cash account youll only receive Instant Deposits for up to 1000 of the funds from your first deposit If you spend some or all of your Instant Deposits and your scheduled. Trade CFDs with Advanced Analysis Tools. Your funds on Robinhood are protected up to 500000 for securities and 250000 for cash claims because they are a member of the SIPC.

Robinhoods daily withdrawal limit is 50000. Try to leave Robinhood when you feel you are ready to invest seriously too many shenanigans going on there. 10 level 1 8 mo.

Beware of margin trading There are two kinds of brokerage accounts -- cash and margin. As always you wont have to pay tax on a stock simply because its value increased. IRS Building You only owe taxes on a stock after you sell it.

Do companies make money when their stock goes up. Its important to know how taxes on your stocks or cryptocurrency will play out. But now hes reached his limit.

When you cash in your stocks on Robinhood you are selling them for more than you paid for them. If this sounds good then lets get started. If you had 5000 of capital gains and 3000 of capital losses you would now have just 2000 of capital gains to pay taxes on.

You will however need to pay tax on any profits you make when you sell stock. Similarly if you have a Robinhood Gold brokerage account with margin investing disabled you can access at least 5000 in Instant Deposits. Keep in mind though that interest will immediately start accruing on your loan.

Long-term gains are taxed at either 0 15 or 20 depending on your ordinary. Now if you actually borrowed money to buy the stock this is called borrowing on margin then yes you can lose more than you invested. Interested in Investing in Stocks.

Short-term gains will be taxed at your ordinary-income tax rate. However I am afraid of any situation in which I could go into negative territory and end up owing money. That was four months ago.

This means that you can take the difference between what you paid and what you sold for and use that money for whatever you like. I am aware that a stock can lose all value and am prepared for that. You can hold a stock for 40 years and never pay taxes on it until you decide to.

It is certainly possible for you or any investor to owe money to an online brokerage like Robinhood. Is this possible for the type of investing I would be doing. Since then Santer has been in an ongoing highly emotionally charged battle with Robinhood to retrieve his 2400.

All you can do is lose your investment. You can only withdraw cash from your brokerage account. For example lets say you put the 25 into the account but you actually bought two shares.

Commodities Indices Stocks Forex Options More. I know robin hood was considering adding options but havent looked at the broker since they added the feature so it depends on the method of purchase. The only thing you can owe is taxes if you make a lot of money of your investments.

If youre a Robinhood client start with our guide on how to. Interested in Investing in Stocks. Ad 77 of retail lose money.

Santer is hoping the Elliott Advocacy team will join this fight and convince. If you want to withdraw more than you have available as cash youll need to sell stocks or other investments first. I am a beginner looking to invest 100 here and there on the side in addition to my 401k etc.

Can You Owe Money To Robinhood Full Details

My Favorite Options Strategy Passive Income With Cash Secured Puts Youtube In 2022 Option Strategies Passive Income Strategies

Interview With J J Aka Vwaptrader1 Marketing Word Of The Day Forextrading

Robinhood Investors Confused Over How Much Tax They Must Pay For Trading Stocks Bloomberg

What Are Exchange Traded Funds Etfs Money

How Robinhood Makes Money On Customer Trades Despite Making It Free

Robinhood Lets You Lend Out Your Stocks For Extra Cash Protocol

Free Debt Tracker Spreadsheet Debt Tracker Credit Card Payment Tracker Debt

Bernie Sanders Income Tax Brackets How Much Would You Owe The Motley Fool The Motley Fool Social Security Benefits The Fool

/cdn.vox-cdn.com/uploads/chorus_asset/file/20073515/pandemic_trading_board_1.jpg)

Robinhood Reddit And The Risky Market Of Amateur Day Trading Vox

My Neighbor Told Me He Is Making Money Day Trading Mostly With Apple Stock How Much Money And Time Would Be Needed To Take Advantage Of Market Fluctuations To Make A Couple

Infographic This Is How Credit Actually Works Finance Infographic Infographic Money Basics

Warren Buffett S Favorite Valuation Metric Is Ringing An Alarm Stock Market Stock Market Crash Us Stock Market

I Owe Robinhood 30 000 The Real Risks Of Day Trading Youtube

/robinhood-5bfc3b9cc9e77c00519ed9f1.jpg)

Is Robinhood Safe For Investors

Robinhood Froze My 2 400 How Do I Get This Money Back Elliott Advocacy

:max_bytes(150000):strip_icc()/TheDangerousLureofCheapoutoftheMoneyOptions1-1e3d7a1ba4b5403f8fadef0cffa42d6c.png)